As the IRC continues to transition to its new SIGTAS platform they have advised that they will commence strict enforcement of the existing penalty rules for late payment of tax and late lodgement of returns and other documents. The IRC have acknowledged that penalty rules have not been properly applied in the past but their new system will automatically issue penalties for late payment and late lodgement. This means that taxpayers will need to put systems in place to ensure payments and lodgements are made with the IRC on a timely basis.Tax penalty regime:

Penalties imposed on non-lodgement of returns and documents range from an initial penalty of between K500 to K5,000 per outstanding return, plus an ongoing penalty of K50 per day. In some cases the IRC has the power to impose higher penalties, linked to tax due, for non-lodgement of returns and documents. Penalties for late payment of tax will typically be 20% per annum of the tax outstanding. In some cases the IRC has the power to impose higher penalties for late payment. Where an agreement is entered into by the taxpayer and IRC Debt Management for instalment payments, negotiation of late payment penalties should be included in the discussion.Remittance of penalties:

The IRC does have the power to remit penalties in circumstances where they consider it is reasonable to do so. However, it is important to note that penalties will be automatically applied and taxpayers will need to formally seek remission after the penalties have already been imposed. The IRC have indicated that the circumstances in which remission will be granted are quite limited.

Penalties imposed on non-lodgement of returns and documents range from an initial penalty of between K500 to K5,000 per outstanding return, plus an ongoing penalty of K50 per day. In some cases the IRC has the power to impose higher penalties, linked to tax due, for non-lodgement of returns and documents. Penalties for late payment of tax will typically be 20% per annum of the tax outstanding. In some cases the IRC has the power to impose higher penalties for late payment. Where an agreement is entered into by the taxpayer and IRC Debt Management for instalment payments, negotiation of late payment penalties should be included in the discussion.Remittance of penalties:

The IRC does have the power to remit penalties in circumstances where they consider it is reasonable to do so. However, it is important to note that penalties will be automatically applied and taxpayers will need to formally seek remission after the penalties have already been imposed. The IRC have indicated that the circumstances in which remission will be granted are quite limited.

Directors’ liability for salary or wages tax:

In 2010, the Government amended the Income Tax Act to impose a personal liability on the directors of a company when salary or wages tax is not remitted to the IRC by the due date. The IRC has advised that it has commenced issuing director penalty notices under these new laws, and will continue to pursue directors for outstanding salary or wages tax.

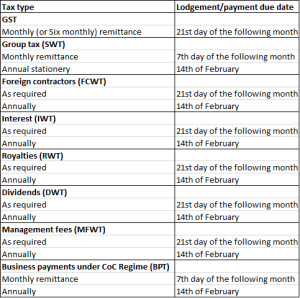

Due Dates:

As a reminder, we have summarised the due date for various lodgements and payments. Should you have any queries, or require any further information please contact your PwC tax adviser.

This article was kindly provided by PriceWaterhouseCoopers.